By Tracey I. Levy and Alexandra Lapes

By this January 2021, paid sick leave laws will impact all employers throughout the tri-state area of Connecticut, New Jersey, and New York. The laws have some commonalities, but there are notable differences across jurisdictions that make it challenging for employers to draft a uniform policy.

Consensus at the Macro Level:

The sick leave laws all permit eligible employees of covered employers to accrue up to 40 hours of sick leave per calendar year. This leave can, at a minimum, be used for the employee’s or family member’s illness, injury, or preventive medical care or treatment, and if an employee or family member is a victim of domestic violence/sexual violence (including the need to obtain related safety measures). Employees minimally must provide notice as soon as practicable prior to taking a sick day. For absences of more than three consecutive days, employers may request documentation to substantiate the need for leave but must keep confidential the information they receive. In addition, all prohibit retaliation against employees who exercise their sick/safe leave rights.

Divergence in Key Details:

Connecticut’s sick leave law is limited to non-exempt service works (as defined by the US Bureau of Labor Statistics), excluding manufacturing and not-for-profits. The New Jersey, New York City, and New York State laws apply to all private employers, although in New York State and New York City, the leave need only be paid if the employer has 5 or more employees, unless an employer made more than $1 million in the previous tax year, and employers with 100 or more employees must provide a total of 7 days (56 hours) of paid sick/safe leave per calendar year.

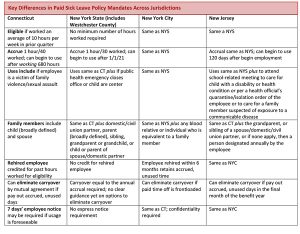

The following chart summarizes key jurisdictional differences that relate to employment policies. Employers should additionally be mindful that Connecticut, New York City and New Jersey all require providing employees with notice of their sick leave rights, and New York City and State impose additional recordkeeping requirements on employers with regard to paid sick leave accruals.